Mponua Rural Bank posts strong financial performance

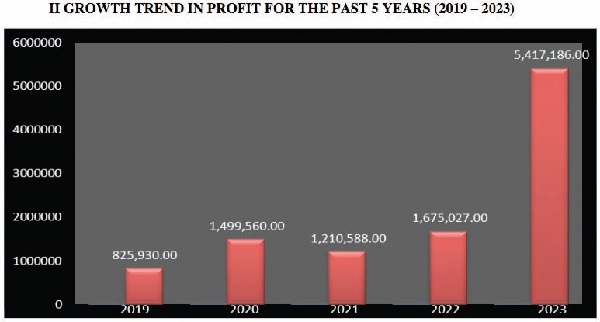

Mponua Rural Bank posted a profit of GH¢5.4 million in the 2023 financial year. This represents a growth of 223.41 per cent over the 2022 profit figure of GH¢1.6 million.

The feat was mainly attributed to significant increases in income realised from investments and loans and advances coupled with stringent cost control measures during the year under review.

Stated capital, shareholder’s funds

The bank’s stated capital in 2023 stood at GH¢ 2,467,665.00 from 2022 level of GH¢2,462,145.00, giving a marginal increase of GH¢5,520.00 or 0.22 per cent.

The bank said although it has been able to comply with the prescribed minimum capital requirement of GH¢1 million by the Bank of Ghana, in order to enhance its capacity to expand operations and maintain facilities to establish desirable standards, shareholders and the public are being entreated to buy more shares to increase

the stated capital.

Advertisement

The bank also recorded an increase of 58.34 per cent in shareholders’ funds from 2022 level of GH¢8,988,310.00 to 2023 level of GH¢14,232,015.00 adding that the growth in the bank’s net profit largely accounted for the appreciable growth of the Shareholders’ Funds.

Dividend

In view the sterling performance of the bank, the board proposed cash dividend of GH¢0.3616 per share for the first time in the history of our bank.

The amount involved is GH¢541,718.60, constituting 10.0 per cent of net profit and duly approved by Bank of Ghana.

Performance analysis

Giving an over of the bank’s performance analysis, the Board Chairman of the bank, Daniel Ohene K. Owusu, at the annual general meeting of the bank said the bank recorded a growth in total assets from 2022 level of GH¢64.96 million to GH¢83.34 million in 2023, representing an increase of 28.29 per cent.

This increase, Mr Owusu said was largely financed by the growth in deposits and shareholders’ funds by 26.55 per cent and 58.34 per cent to the levels of GH¢67.91 million and GH¢14.23 million, respectively.

The total assets expansion was prudently deployed on earning assets with investments growing by 31.78 per cent to end of year balance of GH¢45.46 million as well as net loans increasing by 30.44 per cent to GH¢15.34 million.

Mr Owusu said total assets recorded persistent growth over the period with annualised rate of 25 per cent, while 2023 indicated a growth rate of 28.29 per cent, adding that the highest growth recorded was 44.9 per cent in the year 2020.

Deposits experienced persistent increasing trend and recorded an annualised growth of 25 per cent for the period, with 26.55 per cent attained in 2023.

Savings Deposit continued to be the major source of fund mobilisation, with a share of 42.10 per cent and Susu followed with 36.63 per cent.

However, Mr Owusu added that Susu deposit grew by 30.71 per cent over 2022 level of GH¢19,033,218.00, followed by current deposit by 26.76 per cent over 2022 level of

GH¢5,835,763.00.

“The Investment portfolio grew by 31.78 per cent in 2023 from a portfolio level of GH¢34.50 million in 2022 to GH¢45.46 million in 2023.

Total loans and overdraft disbursed in 2023 amounted to GH¢35.26 million and this indicates an increase of GH¢10.10 million or 40.19 per cent over the amount of GH¢25.15 million in 2022,” he added.

Image

“Mponua Rural Bank Limited was rated strong throughout the four quarters in 2023 and due to its persistent hard work has been ranked as the number one Rural and Community Bank in the whole country for the first quarter ended March 31, 2024 by the ARB Apex Bank PLC.

This is the third time that Mponua Rural Bank as attained this prestigious feat,” he said.

Mr Owusu also informed shareholders that the bank has been admitted into the Ghana Club 100 by the Ghana Investment Promotion Centre.

“During the recent 21st Edition of Ghana Club 100 Awards Ceremony, Mponua Rural Bank was ranked 55th among the elite companies in Ghana and 3rd in the rural banking sector.

These prestigious Awards have given recognition of the unwavering commitment of our bank in delivering exceptional quality banking services to the public towards the realisation of our strategic corporate objectives and values.