Ghana Gold Coin goes on sale: Bank of Ghana announces pricing

The Bank of Ghana has officially unveiled the pricing guidelines for the Ghana Gold Coin (GGC), offering Ghanaians a unique investment opportunity in precious metals.

The coins, which are available in one ounce, half ounce, and quarter ounce denominations, are issued and guaranteed by the central bank.

Design and features

The Ghana Gold Coin is crafted from refined gold with a purity level of 99.99 percent, showcasing the original gold colour. Each coin features the Ghana Coat of Arms on one side and the Independence Arch on the reverse, symbolising the nation’s heritage and resilience.

The coin dimensions vary based on weight:

- The 1-ounce coin measures 34mm.

- The half-ounce coin measures 27mm.

- The quarter-ounce coin measures 22mm.

Advertisement

Pricing and availability

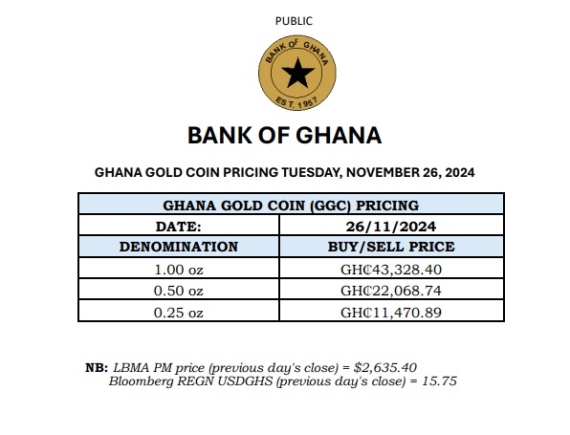

The central bank has set the prices for the coins based on the London Bullion Marketing Association (LBMA) Auction PM Price and the Bloomberg REGN Mid-Rate from the previous day’s close. On November 26, the prices were announced as follows:

The pricing mechanism allows for daily adjustments in line with international gold rates.

How to Buy

The GGC can only be purchased in Ghana through commercial banks using cedi. Banks will act as intermediaries, requiring customers to open gold accounts with the Bank of Ghana to facilitate transactions. Banks may also charge a uniform transaction fee for resale, covering the coin's value-added costs and the wooden storage box.

Purpose and Benefits

The introduction of the Ghana Gold Coin is part of the Bank of Ghana’s domestic gold purchase programme, aimed at bolstering the national economy. Governor Dr Ernest Addison highlighted its dual benefits: “The issuance of the GGC democratizes access to this enduring financial asset, enabling residents to diversify their financial portfolios.”

The coin will also assist the central bank in mopping up excess cedi liquidity in the banking system, complementing tools like the Bank of Ghana Bills for open market operations.

Investment Opportunity

The GGC offers Ghanaians a chance to invest in a stable, internationally valued asset while promoting local gold usage. This initiative aligns with the Bank of Ghana’s vision to make gold investment accessible to a broader audience.

For further details, potential investors can contact commercial banks or visit the Bank of Ghana’s website.