FBN Bank relaunches two savings products

FBN Bank Ghana has relaunched two savings account products which will provide customers with an interest margin of two per cent more than is available on the market currently.

The products are the FBNBank Prestige Savings Account and the Young Super Save Account.

The FBNBank Prestige Savings Account is a special hybrid savings account that has features of both savings and current account.

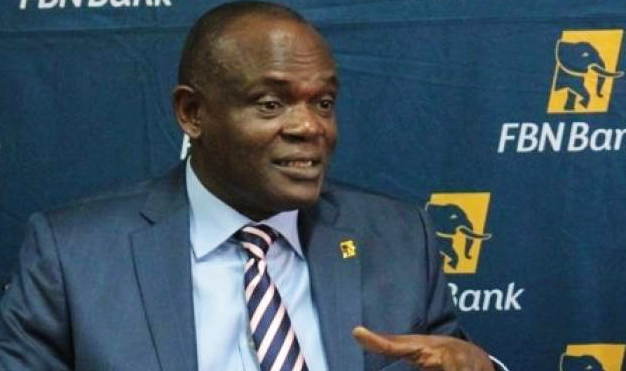

The Chief Executive Officer of the bank, Mr Gbenga Odeyemi, explained that “unlike the typical savings accounts where customers are unable to write a cheque- to a third party, the Prestige Savings has a unique third party cheque writing facility because we understand that our customers may have more money in their savings accounts and may need to disburse some to others from time to time.”

Advertisement

“This account can also be used as collateral for a loan facility and customers can make standing orders on the account to enjoy the ease of paying bills and making transfers,” he added.

The bank also relaunched its Young Super Save Account designed for children under 18. He said: “As tertiary education becomes increasingly expensive, this account provides the platform for parents and guardians to save towards the funding of their children and wards’ tertiary education, as well as engender the savings culture in them. He, therefore, encouraged all parents and guardians to patronise the Young Super Save Account to ensure a good stock of fund accumulation towards future expenditure.” The account can be used to secure a facility and also allow customers to access loans without disrupting the investment made.

He noted that “we have different categories of customers whose needs and preferences vary. We, therefore, see this as an opportunity to put our customers first before everything else”.

Mr Odeyemi also stated that “we will continue to consider our clients’ sociocultural and economic needs in order to develop relevant products and services for them, “adding that the bank is currently working towards unveiling more products and services before the end of the year”.