Gold Board must expand customer due diligence — Steve Manteaw

When established, the Gold Board will, among other things, have to expand the customer due diligence process around gold trading to include the application of Beneficial Ownership (BO) data.

This is to clear the minds of the public on the people who were behind gold buying business in the country and also to ensure that no suspicious characters were trying to either launder money or derive resources that might eventually go to finance serious organised crime against Ghana.

The Workstream Technical Advisor of the UK-Ghana Gold Programme, Dr Steve Manteaw, who gave the advice, said the current approach whereby the proprietor or proprietress of companies registering to trade in gold were required to submit only a police report was simple and not good enough.

He said the absence of the BO in the gold system was affecting the sector, adding that was why as a country, Ghana did not have a very firm hold on its gold trade.

Advertisement

“Most of our gold is leaving this country through unapproved channels. Others are also being taken out through approved channels but undervalued and all of that.

We have created a regime where I believe a lot of unscrupulous persons are actually operating in the gold sector.

The incoming board should be able to implement the BO on gold,” he reiterated.

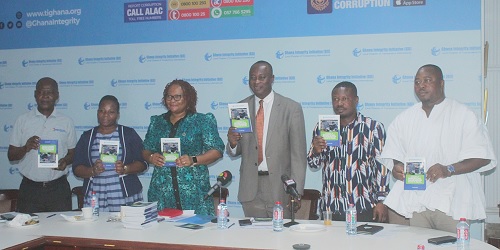

Dr Manteaw said this in an interview with the Daily Graphic on the sidelines of the launch of a report on the assessment of the Beneficial Ownership (BO) regime in Ghana by the Ghana Integrity Initiative (GII).

Beneficial Ownership

Beneficial Ownership refers to the natural person(s) who ultimately owns or controls a company or legal entity, either directly or indirectly, and who ultimately benefits from its activities or exercises control over it.

Ghana's Companies Act 2019 (992) mandates those who want to register companies or companies that were already in existence to provide information on the BOs, especially those who are politically exposed persons. This information is supposed to be recorded in the central register managed by the Registrar of Companies.

The objective of the BO is to promote good governance and accountability, minimise and eventually eradicate corruption-related assets such as money laundering, financial terrorism and transnational organised crimes and prevent the illicit flow of finances into Ghanaian companies.

But Dr Manteaw said at the moment, the country did not have a BO for the gold system and that was why it was important to have it so that the names and identities of the people who were behind the gold buying business would be known.

If implemented, he said, then when one applied for a licence from the gold board, they would check who the propretors were and those behind the company that was applying for the licence.

“We live in a country where all our gold is being bought mostly by foreigners who export the gold into their countries, sell, make money in foreign currency, and the money doesn't come back into the economy, depriving us of what the money could have done for us in terms of shoring up our local currency if the dollars were to be brought into the country,” he stated.

Transactions

Earlier at the launch, reacting to a comment that the gold sector was one area the country had failed to report suspicious transactions report, the Country Representative of Global Financial Integrity (GFI), Maxwell Kuu-Ire, stressed the need to do a lot more education, create awareness and give assurance that the whistleblower protection act was really sufficient to protect them.

The Executive Director of GII, Mary Awelana Addah, said the issue about people not reporting suspicious transactions in the gold sector was because people thought it was not their business, adding that there was no incentive and asked that they revisit the whistleblower motivation.

Presenting the findings of the assessment, Michael Kwame Boadi, said they realised that although the country had brilliant and robust laws as far as BO disclosure was concerned, there were gaps in the implementation.

He mentioned one of the key gaps to be that various competent authorities, including law enforcement agencies that wanted to access the register, had to go to the Registrar of Companies to be able to ask them for the information and that, he added, could compromise the investigation.

“So there should be greater collaboration within the competent authorities so that at the click of their button, they will be able to access the BO information to help in their investigation,” he said.