Don’t rush negotiations with Creditor Committee — Govt urged

Two Economists have advised the government to focus on getting a better deal for the country as it engages the Official Creditor Committee (OCC) and not rush into accepting any deal that will not serve the purpose of the debt restructuring exercise.

Although they admitted that the delays in getting a deal with the OCC could pose some challenges for the economy, they said the consequences of not getting a better deal could be direr and, therefore, urged the government not to rush in getting any deal.

Speaking in an interview with the Graphic Business, Economist and Head of Research at the Institute of Fiscal Studies (IFS), Dr Said Boakye, said, “The government must get a good deal from the creditors; the government should not rush in getting just any deal”.

“The extreme debt overhang is very troubling so it is necessary to get a better deal and not just any deal. So if it is delaying and at the end, we will get a good deal, it is better than rushing through to get a deal which won’t favour us,” he stated.

Advertisement

As of going to press yesterday, the government was locked up in a meeting with the OCC co-chaired by France and China, as it seeks to restructure its US$5.4 billion debt to bilateral creditors.

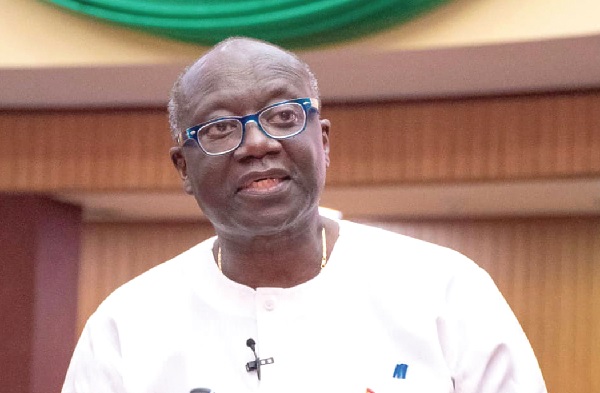

The Finance Minister, Ken Ofori Atta, in an interview with Bloomberg, said the government was confident it would soon reach an agreement with the OCC to enable the Board of the IMF to sit by January 25 to approve and release the second tranche of US$600 million out of the US$3 billion bailout fund.

Following the formation of the OCC in May 2023, the Executive Board of the IMF immediately approved Ghana’s three-year IMF programme and immediately released the first tranche of US$600 million to the country.

The second tranche of another US$600 million was hinged on the first review of the country’s IMF programme in October 2023.

On October 6, the IMF staff and the government reached a staff-level agreement on the first review. However, an Executive Board level approval which will trigger the release of the money has not been possible due to the government’s inability to secure an MoU with OCC.

Mr Ofori Atta, in an earlier interview with the media on November 30, said the government had completed all it had to do with the fund and all its papers had been distributed to the various directors and was waiting for a formal response from the OCC.

He said the OCC was looking at issues of the cut-off dates and their implications to each of the credits that the various countries have given and was confident that those analyses would be done by the first week of December 2023.

He added that another issue was the comparability of treatment to ensure that all creditors have been fairly impacted.

Debt forgiveness

Despite the challenges in securing a deal with the OCC, Dr Said Boakye said the government must still push for some debt forgiveness.

“The government must let the creditors understand that it is very critical for the country to get some form of debt forgiveness. We should let them understand that if these negotiations fail, the country will not be able to service its debt, which would affect the creditors as well.

“Even though China is playing hardball, we must still emphasise it and back it with a commitment that the country will put measures in place to ensure this does not happen again,” he stated.

Pressure on Economy

Also speaking in an interview with the Graphic Business, Economist and Lecturer and the Academic City University, Eugene Bawelle, said the inability of the government to reach an agreement with OCC puts a lot of pressure on the already fragile economy.

He said with the release of the second tranche of IMF money still pending, the government’s source of financing the fiscal deficit continues to be limited to the treasury bill market as the secondary market has become virtually non-existent post the domestic debt restructuring exercise.

“With the high treasury bill rates, it’s only a matter of time before the treasury bill market also crushes,” he stated.

Mr Bawelle said the government had not fully appreciated the kind of creditor it was dealing with in China.

“China is not a country that forgives debts. Check countries like Zambia and Sri Lanka which recently went through the same process. China will either extend your repayment duration or reduce the rate of the interest you will pay.

“It’s a very difficult bargain to get China to forgive debts. So the government’s attempt at getting China to agree to a debt forgiveness must be extremely compelling,” he stated.

External debt relief

The government is targeting an external debt relief of US$10.5 billion between 2023-2026 as it engages its external creditors, who include both bilateral and commercial, for debt restructuring.

The government announced a suspension of debt service on external commercial obligations on December 19, 2022, and has since then been engaging with them on a debt restructuring.

The government is seeking to restructure debts totalling $14 billion, out of which $13 billion are in bonds with its external commercial creditors.

On the commercial side, the Finance Minister, in his last update, said two bondholder groups have been formed, comprising domestic and regional bondholders and international bondholders.

“We have engaged in good faith discussions with both of them and shared illustrative debt restructuring scenarios in May.

“We have now received debt treatment scenarios from both bondholder groups and expect to accelerate our constructive dialogue in the upcoming weeks,” he said.

Under the IMF programme, the country is expected to reduce its debt-to-GDP ratio from the current 93.5 per cent to 55 per cent.