Producer price inflation inches up to 10.3%

The Producer Price Inflation (PPI) rose to 10.3 per cent year-on-year in July 2016 from the 7.6 per cent recorded in the previous month.

According to the Ghana Statistical service, the 2.7 per cent increase in the month’s producer inflation was fueled by activities in the mining and quarrying sub-sector as a result of hikes in gold prices on the international market.

The manufacturing sub-sector recorded the lowest month-on-month inflation rate at -0.2 per cent, preceded by the utilities sub-sector which recorded an inflation rate 0.1 per cent.

The inflation in the mining and quarrying sub-sector surged to 6.4 per cent. The month-on-month change in the producer producer price inflation appreciated by 0.9 per cent in July 2016 as against a 1.2 per cent change in June 2016.

Advertisement

Government treasury securities

The Government of Ghana 91-day treasury security rate advanced by a basis point to 22.85 per cent as the 182-day treasury security rate also appreciated by two basis points to settle at 24.69 per cent. All other securities maintained their yields.

The Government of Ghana accepted all GH¢945.36 million worth of bids that were tendered at the auction held on August 19. The total amount, however, did not meet Government’s target of GH¢1,332.00 for the week.

The government’s target for the auction to be held on August 26 is GH¢1.24 billion with respect to the 91-day and 182-day treasury securities.

The yield curve retained its previous week’s shape as the rise in the 182-day security rate foiled the attainment of a normal yield curve. The government’s effort to address its debt structure towards long-dated instruments was weakened by the risk-return expectation of the investment community. Investors’ preference for short-and-medium term securities were soared as their risk-return expectations were not adequately met for the issue of long-dated instruments.

Currency market

On the forex market, the US dollar rose 0.08 per cent against the Ghana cedis amidst strong industry news and economic data. The greenback rebounded to widen its year-to-date gains against the local currency to 4.01 per cent as Federal Reserve Chair Janet Yellen communicated hopes of possible interest rate hikes at the central bankers summit on Friday.

The Dollar was also boosted by reports that demand for US durable goods surged by 4.4 per cent to a six-months high in July and jobless claims dipped by 1,000 to 261,000 as the US labour market rebounded.

The Pound rose 0.35 per cent against the Ghana Cedi as the UK retail sales data posted strong performance since February slump following the referendum on EU membership. The Cedi depreciated to lessen its year-to-date gains against the Pound to 7.29 per cent as data showed that retail sales in the UK rose 1.4 per cent month-on-month in July 2016, following a 0.9 percent fall in June and beating market expectations of 0.2 percent gain.

The strong retail sales data showed heightened consumer demand which signals the revival of economic activities in the UK since the June referendum.

The Euro lost by 0.29 per cent against the Ghana Cedi despite the results of the survey of purchasing managers (PMI) which asserted that the preliminary gauge of economic activity in the eurozone rose to a seven-month high. The year-to-date performance of the Cedi inched up against the Euro to settle at 7.79 per cent.

Commodities

Commodities ended generally lower with the brent crude oil tumbling by 2.99 per cent as news of intended producer talks to rein in oversupply broke out. Crude prices edged lower on the international market as the surprise build up in U.S. crude inventories last week disappointed investors amidst renewed concerns about the oversupplied oil market.

The U.S. commercial stockpiles of crude oil and refined products increased by 6.6 million barrels last week to a record of 1.4 billion barrels.

Gold price fell by 2.25 on the international market as upbeat U.S data signaled higher U.S interest rate hikes in the upcoming Federal Reserve meeting.

Gold futures slipped after industry news and economic reports offered hopes of interest rate hikes as weekly unemployment claims fell to 261,000 and U.S durable-goods orders jumped 4.4 per cent in July.

Cocoa shed 2.61 percent over the week to trade at US$3,028 per tonne on Thursday as traders exhibited intense concerns over cocoa supplies as weather conditions in Ivory Coast impeded the growth of the smaller mid-crop beginning in October.

Though, cocoa prices trended northward on Thursday, the supply crunch could not suppress the losses made over the week.

Coffee prices surged by 4.49 per cent to trade at US$1.44 amidst currency fluctuations in top grower, Brazil. The price of coffee gained momentum this week following concerns that weather issues in Brazil would negatively impact the crops yield. — IGS Financial Services/GB

Ghana Stock Exchange

The stock market enjoyed its post July performance as top gainers added value to the equity indices. The GSE-Composite Index added 11.51 points to close the week at 1,812.91points while the GSE-Financial Stock Index inched up by 13.61 per cent to close at 1,720.06 points.

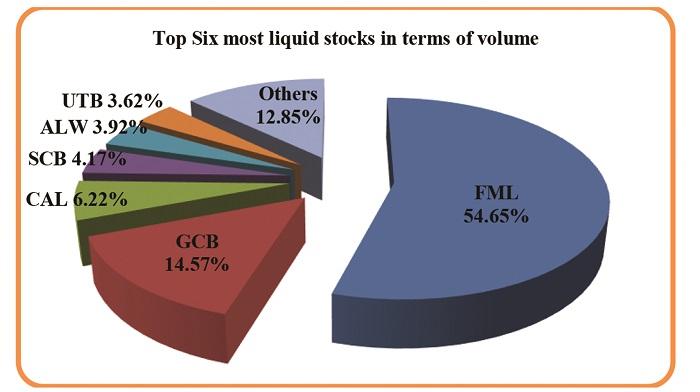

The GSE-CI and the GSE-FSI closed the week with year-to-date losses of 9.12 per cent and 10.88 percent respectively. The equity market recorded a total trading volume of 69,045.00 shares compared to 700,414.00 in the previous week’s trading session, representing a 90.14 percent decline.

The total value of stocks traded fell by 97.75 per cent to end the week at GH¢63,509.23. In terms of volume and value traded, Fan Milk Ghana Limited emerged as the most actively traded stock, accounting for 54.65 percent and 78.89 percent of the total traded shares respectively at the close of the week’s trading session. The week-on-week total market capitalisation tumbled by 0.91 percent to close at GH¢54,070.43 million.

The final trading week of the month of August experienced price gains in six stocks and losses in eight stocks. UT Bank and HFC Bank added 1 pesewas apiece to trade at 7 pesewas and 72 pesewas respectively. SIC and GCB Bank made price gains of 2 pesewas and 10 pesewas to close the trading week at 17 pesewas and GH¢4.10 per share respectively. Standard Chartered Bank’s Preference share inched up by one pesewa to trade 75 pesewas while Fan Milk Ghana Limited moved up eight pesewas to close at GH¢9.50 per share.

Irrespective of the price gains, eight stock experienced loses to close the trading week. Benso Oil Palm Plantation and Total Petroleum lost 10 pesewas apiece to trade at GH¢2.70 and GH¢2.90, while Ecobank Transnational Incorporation and Tullow Petroleum Company trimmed 2 pesewas to close the week at 15 pesewas and GH¢27.86 per share respectively.

Ayrton Drugs and Ghana Oil Company Limited shed a pesewas each at the end of the trading week. Cal Bank fell by two pesewas, while Golden Star Resources lost four pesewas per share to conclude the list of laggards for the trading week.